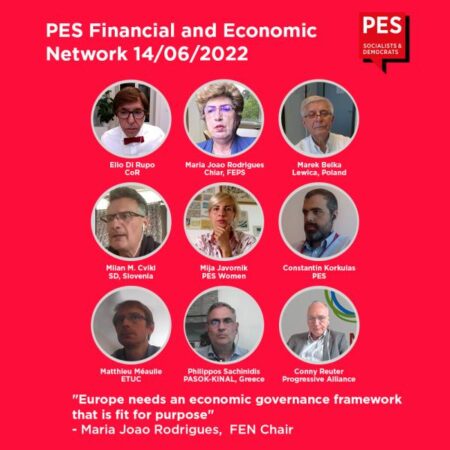

To respond to the economic consequences of the Ukraine war and the coronavirus pandemic, representatives of PES member parties, S&D Group Members of the European Parliament and affiliated organisations made the case for a review of the European economic governance rules to allow for public investments – especially in the twin transitions – to incorporate more realistic fiscal targets, promote debt sustainability and economic viability, and account for the consequences of the sanctions on Russia, alleviating the burden on the most vulnerable families.

Meeting Chair, FEPS President Maria Joao Rodrigues, said:

“In these times of great uncertainty and geopolitical turmoil it is important to be proactive. After a series of consecutive crises, it is necessary to re-evaluate Europe’s autonomy and sustainability. Strengthening REPowerEU with the Resilience and Recovery Facility (RRF) shows that Europe needs a robust and permanent investment strategy. Extending the General Escape Clause for another year shows the added value of a more relaxed fiscal framework. Our political family has long been calling for greater fiscal flexibility and for bold European measures to actively promote economic growth and social progress. Today our calls are more relevant than ever.

“The war in Ukraine has pushed Europe to take bold decisions to strengthen its autonomy. This new environment cannot way disproportionately on citizens or countries. As Europe establishes new green, industrial, digital, and economic strategies to mitigate future developments it needs to establish new fiscal, financial and social frameworks to ensure sustainability and wellbeing. If not, greater autonomy will come at a great social cost.”

The current inflation pressure and the risk of stagflation were also debated by Network members. The risk of increasing social inequalities and the loss of purchasing power was considered as a grave political risk for the stability of our continent and our union. As such, measures to mitigate energy price hikes and protect the most vulnerable have to be implemented.

Finally, the Network exchanged on the completion of the Banking Union and expressed the need to develop the Capital Markets Union in order to increase investment opportunities that are necessary to achieve Europe’s long-term goals.

The Network will retain a close watch on the upcoming economic governance review by the European Commission, on the developments of the banking union, and in other areas, and will take stock of developments.